Bottled water generates sales of $18.5 billion in U.S. multi-outlets, IRI reports

Even before the COVID-19 pandemic, consumers were turning to the $18.5 billion bottled water category to quench their thirst, IRI data states. There also are more options from which to choose, including still, sparkling, flavored and enhanced waters. (Image courtesy of hint Inc.)

In the 1989 Disney musical “The Little Mermaid,” Sebastian the crustacean looks to convince the feisty mermaid Ariel that everything is better “Under the sea, darling it’s better, down where it’s wetter, take it from me.” When it comes to the beverage market, few other categories are doing better than the bottled water category.

The COVID-19 pandemic and the resulting stockpiling of bottled water also has positively impacted category performance and accelerated growth, says Gary Hemphill, managing director of research for New York-based Beverage Marketing Corporation (BMC).

“Bottled water is continuing on a solid growth trajectory, and has actually experienced accelerated growth in the first half of 2020,” Hemphill explains. “It’s positioning as the ultimate health drink continues to resonate with consumers. Additionally, the category has been boosted in recent years by [the] growing popularity of sparkling water.

“The pandemic has indeed impacted category performance,” he continues. “The first half of 2020 has been a tale of two quarters with the first quarter benefiting from stockpiling and the second quarter seeing soft performance due to first quarter stockpiling and the closure of many on-premise outlets.”

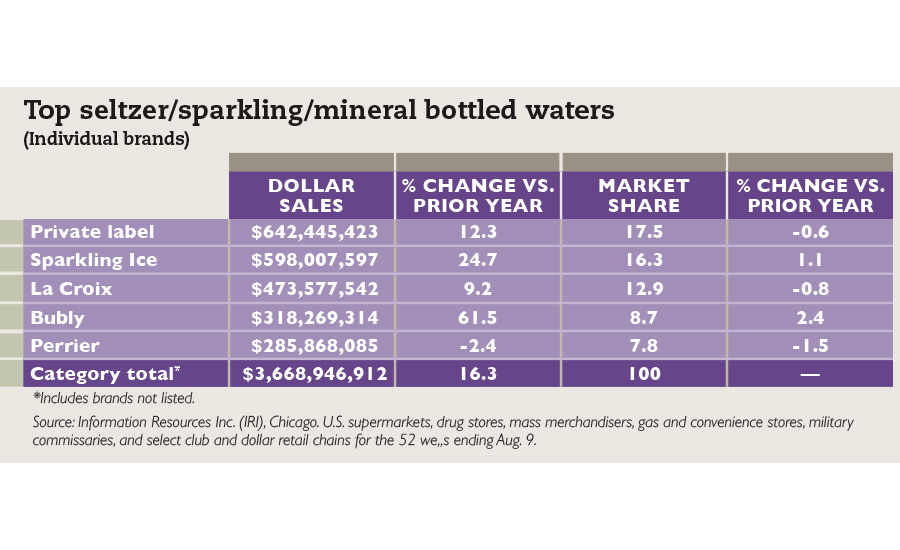

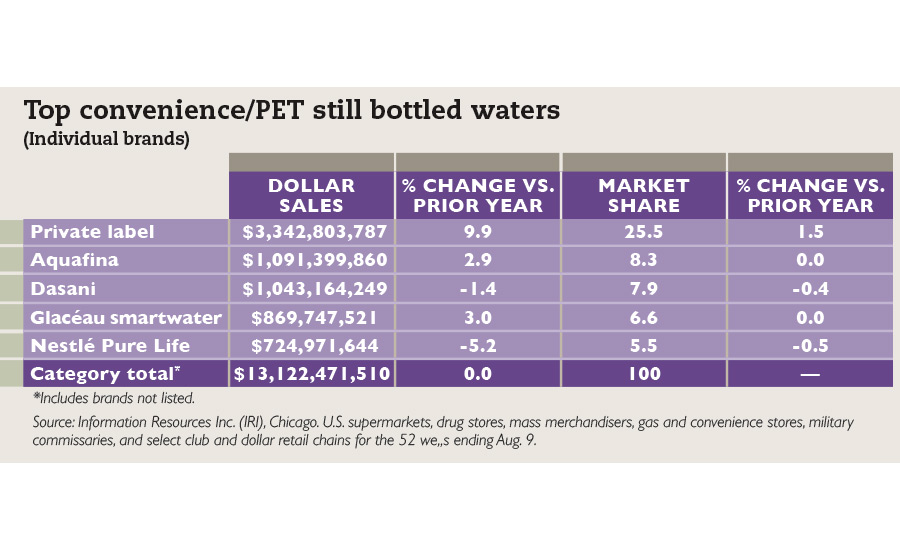

The overall bottled water category generated dollar sales of $18.5 billion, a 5.9 percent increase in total U.S. multi-outlets and convenience stores for the 52 weeks ending Aug. 9, according to data from Chicago-based Information Resources Inc. (IRI). In the same timeframe, convenience/PET still bottled waters recorded dollar sales of $13.1 billion, a 3.2 percent increase. From a smaller base, seltzer/sparkling/mineral bottled waters generated a year-over-year (YOY) increase of 16.3 percent and sales of $3.6 billion, while jug/bulk still waters saw sales of $1.7 billion, a 6.8 percent increase, IRI data reports.

At roughly four times the size of the sparkling water market, still water often overshadows sparkling water. Yet, consumer interest in sparkling waters and functional waters are making a splash in the category, says Caleb Bryant, associate director of food and drink reports at Chicago-based Mintel.

“Functionality continues to be a major trend within the water market; for example, Nestlé recently launched their new line of Pure Life+ Enhanced Water. Twenty-five percent of all consumers have purchased functional water in the past three months,” Bryant says. “… Sparkling water is one of the fastest growing non-alcoholic beverage categories. The sparkling water market [compound annual growth rate] (CAGR) from 2015-2019 was 15.8 percent compared to 5.8 percent for still water.”

Bubbling over with growth

As beverage-makers experiment with new ways to improve water’s hydrating ability and add extra health benefits, the bottled water category continues to its premium turn. Additionally, as bubbles permeate water and other beverage categories, the enhanced waters segment is no exception.

The overall bottled water category generated dollar sales of $18.5 billion, a 5.9 percent increase in total U.S. multi-outlets and convenience stores for the 52 weeks ending Aug. 9, according to data from Chicago-based Information Resources Inc. (IRI). In the same timeframe, convenience/PET still bottled waters recorded dollar sales of $13.1 billion, a 3.2 percent increase. From a smaller base, seltzer/sparkling/mineral bottled waters generated a year-over-year (YOY) increase of 16.3 percent and sales of $3.6 billion, while jug/bulk still waters saw sales of $1.7 billion, a 6.8 percent increase, IRI data reports.

At roughly four times the size of the sparkling water market, still water often overshadows sparkling water. Yet, consumer interest in sparkling waters and functional waters are making a splash in the category, says Caleb Bryant, associate director of food and drink reports at Chicago-based Mintel.

“Functionality continues to be a major trend within the water market; for example, Nestlé recently launched their new line of Pure Life+ Enhanced Water. Twenty-five percent of all consumers have purchased functional water in the past three months,” Bryant says. “… Sparkling water is one of the fastest growing non-alcoholic beverage categories. The sparkling water market [compound annual growth rate] (CAGR) from 2015-2019 was 15.8 percent compared to 5.8 percent for still water.”

Bubbling over with growth

As beverage-makers experiment with new ways to improve water’s hydrating ability and add extra health benefits, the bottled water category continues to its premium turn. Additionally, as bubbles permeate water and other beverage categories, the enhanced waters segment is no exception.

The overall bottled water category generated dollar sales of $18.5 billion, a 5.9 percent increase in total U.S. multi-outlets and convenience stores for the 52 weeks ending Aug. 9, according to data from Chicago-based Information Resources Inc. (IRI). In the same timeframe, convenience/PET still bottled waters recorded dollar sales of $13.1 billion, a 3.2 percent increase. From a smaller base, seltzer/sparkling/mineral bottled waters generated a year-over-year (YOY) increase of 16.3 percent and sales of $3.6 billion, while jug/bulk still waters saw sales of $1.7 billion, a 6.8 percent increase, IRI data reports.

At roughly four times the size of the sparkling water market, still water often overshadows sparkling water. Yet, consumer interest in sparkling waters and functional waters are making a splash in the category, says Caleb Bryant, associate director of food and drink reports at Chicago-based Mintel.

“Functionality continues to be a major trend within the water market; for example, Nestlé recently launched their new line of Pure Life+ Enhanced Water. Twenty-five percent of all consumers have purchased functional water in the past three months,” Bryant says. “… Sparkling water is one of the fastest growing non-alcoholic beverage categories. The sparkling water market [compound annual growth rate] (CAGR) from 2015-2019 was 15.8 percent compared to 5.8 percent for still water.”

Bubbling over with growth

As beverage-makers experiment with new ways to improve water’s hydrating ability and add extra health benefits, the bottled water category continues to its premium turn. Additionally, as bubbles permeate water and other beverage categories, the enhanced waters segment is no exception.

The overall bottled water category generated dollar sales of $18.5 billion, a 5.9 percent increase in total U.S. multi-outlets and convenience stores for the 52 weeks ending Aug. 9, according to data from Chicago-based Information Resources Inc. (IRI). In the same timeframe, convenience/PET still bottled waters recorded dollar sales of $13.1 billion, a 3.2 percent increase. From a smaller base, seltzer/sparkling/mineral bottled waters generated a year-over-year (YOY) increase of 16.3 percent and sales of $3.6 billion, while jug/bulk still waters saw sales of $1.7 billion, a 6.8 percent increase, IRI data reports.

At roughly four times the size of the sparkling water market, still water often overshadows sparkling water. Yet, consumer interest in sparkling waters and functional waters are making a splash in the category, says Caleb Bryant, associate director of food and drink reports at Chicago-based Mintel.

“Functionality continues to be a major trend within the water market; for example, Nestlé recently launched their new line of Pure Life+ Enhanced Water. Twenty-five percent of all consumers have purchased functional water in the past three months,” Bryant says. “… Sparkling water is one of the fastest growing non-alcoholic beverage categories. The sparkling water market [compound annual growth rate] (CAGR) from 2015-2019 was 15.8 percent compared to 5.8 percent for still water.”

Bubbling over with growth

As beverage-makers experiment with new ways to improve water’s hydrating ability and add extra health benefits, the bottled water category continues to its premium turn. Additionally, as bubbles permeate water and other beverage categories, the enhanced waters segment is no exception.

The overall bottled water category generated dollar sales of $18.5 billion, a 5.9 percent increase in total U.S. multi-outlets and convenience stores for the 52 weeks ending Aug. 9, according to data from Chicago-based Information Resources Inc. (IRI). In the same timeframe, convenience/PET still bottled waters recorded dollar sales of $13.1 billion, a 3.2 percent increase. From a smaller base, seltzer/sparkling/mineral bottled waters generated a year-over-year (YOY) increase of 16.3 percent and sales of $3.6 billion, while jug/bulk still waters saw sales of $1.7 billion, a 6.8 percent increase, IRI data reports.

At roughly four times the size of the sparkling water market, still water often overshadows sparkling water. Yet, consumer interest in sparkling waters and functional waters are making a splash in the category, says Caleb Bryant, associate director of food and drink reports at Chicago-based Mintel.

“Functionality continues to be a major trend within the water market; for example, Nestlé recently launched their new line of Pure Life+ Enhanced Water. Twenty-five percent of all consumers have purchased functional water in the past three months,” Bryant says. “… Sparkling water is one of the fastest growing non-alcoholic beverage categories. The sparkling water market [compound annual growth rate] (CAGR) from 2015-2019 was 15.8 percent compared to 5.8 percent for still water.”

Bubbling over with growth

As beverage-makers experiment with new ways to improve water’s hydrating ability and add extra health benefits, the bottled water category continues to its premium turn. Additionally, as bubbles permeate water and other beverage categories, the enhanced waters segment is no exception.

您自己的文本

in Chicago-based SPINS “Functional and Enhanced Beverages” report, the wellness-focused data technology company notes that many drinking waters in today’s market offer additional benefits for enjoyment such as carbonation and flavor variety as well as functional ingredients for wellness.

“The overall shelf-stable water segment grew 8.2 percent over the past year to $13.5 billion, and enhanced waters outpaced the segment’s growth at 12.8 percent, amounting to $2.2 billion and 16.3 percent share of the category,” the report states. “Refrigerated coconuts and plant waters generated year-over-year growth of 10.1 percent and dollar volume of $60.7 million.”

SPINS’ segmentation reveals a granular view of the specific product types driving growth among enhanced waters as follows:

- Enhanced water, nutrient— dollar volume, $1.4 billion, 9.2 percent growth

- Enhanced water, electrolyte— dollar volume, $480.6 million, 11.4 percent growth

- Enhanced water, alkaline— dollar volume, $268.7 million, 36.4 percent growth

- Enhanced water, oxygenated— dollar volume, $516,000, 42.6 percent growth

Several water brands are making waves in the market for their health and wellness attributes. For instance, El Segundo, Calif.-based Liquid I.V. announced that its hydration focused electrolyte drink mix launched in more than 500 Costco’s nationwide. The non-GMO, vegan, electrolyte drink mixes provide two to three times more hydration than water alone as the mixes are powered with CTT, a bio-delivery system designed to enhance rapid absorption of water and other key ingredients into the bloodstream, the company says.

To promote hydration for dysphagia patients and those with swallowing disorders, Thick-It and Sqwincher, brands of Kent Precision Foods Group Inc., Muscatine, Iowa, introduced a Clear Advantage Thickened Water + Sugar Free, Low Calorie Sqwincher Qwik Stik ZERO Combo Pack. Each combo pack includes 24 single-serve, resealable bottles of Thick-It Clear Advantage Thickened Water and 24 pre-measured pouches of sugar-free, low-calorie Sqwincher Qwik Stik ZERO. The waters are available in mildly thick and moderately thick varieties in Nectar and Honey, respectively, and the mixes are offered in Mixed Berry and Lemonade.

In addition to health and wellness attributes, SPINS data shows the ascent of sparkling waters across the board, with flavored and unflavored subcategories reporting a combined $2.6 billion in sales and 14.6 percent growth.

Time to sparkle and shine

BMC’s August 2019 report titled “Bottled Water in the U.S. Through 2023,” also notes promise for domestic sparkling waters. “Domestic sparkling water advanced at a double-digit rate, and imports outperformed the overall market, though both still claimed comparatively small shares of volume. Larger, multi-serving bottles provided the exception and volume in this segment was essentially flat from 2018 to 2019,” it states.

Capitalizing on consumers’ quest for functional waters that also are sustainable, in August, Toast H2O alkaline purified water hit retail shelves. (Image courtesy of Toast Distillers Inc.)

The report projects U.S. retail sales of domestic sparkling waters will grow from $1.9 billion in 2018 to $4.9 billion in 2023, while imports will grow from $3.4 billion to $5.4 billion in 2023.

San Francisco-based hint Inc., which offers its zero-calorie unsweetened flavored still waters accented with a hint of natural fruit essence in 17 flavors, also developed Hint Sparkling in seven flavors. A caffeinated water line, Hint Kick, also is available.

Single-serving sizes are the most popular bottled water option, enlarging more than 4 percent to almost 10.1 billion gallons, BMC’s report states. Other segments, including home and office delivery, sparkling water and imports, also registered growth in 2019.

Water brands ‘can it’

Experts note that sustainability and concern about plastic bottles pollution are driving some changes in the bottled water industry.

Although many water brands, particularly enhanced waters, are using aluminum for its environmental benefits, Mintel’s Bryant says he’s interested in tracking the performance of ZenWTR that uses a bottle made from ocean-bound plastics. Unveiled in March, the vapor distilled alkaline water is 9.5 pH and is being produced by beverage entrepreneur Lance Collins from 100% recycled, certified ocean-bound plastic, the company says.

Citing Mintel’s Global New Products Database, Bryant highlights that 46 percent of all water product launches in the United States through August were canned. “For comparison, in 2016, canned water represented 20 percent of all U.S. water product launches,” he explains. “[Furthermore], 59 percent of water purchasers agree with the statement, ‘companies should stop using plastic bottles even if it is more expensive.’”

In August, Miami-based Toast Distillers Inc. unveiled Toast H2O alkaline purified water. The water ― treated with reverse osmosis, UV light, ozone, carbon filter, multimedia filter and microfiltration ― comes in a sleek, long, clear, thin bottle with no adhesive label for easier recycling, it says. The 16.9-ounce, BPA-free bottle features a black top and a classic design with the intent of inspiring consumers to reuse them several times after drinking the original content before discarding in a recycle bin, it adds.

From 2015-2018, the sparkling water market compound annual growth rate was 15.8 percent compared with 5.8 percent for still water, Mintel’s Caleb Bryant says. Additionally, 46 percent of all water product launches in the United States through August were canned. (Image courtesy of Spindrift and Waterloo)

The future remains bright for the water category, particularly as consumer demand for enhanced waters and sparkling waters are strong, assisted by healthy positioning and lots of innovation.

For the 32 weeks ending Aug. 8, the total water category saw U.S. dollar sales of $5.5 billion, a 6.3 percent YOY increase, New York-based Nielsen reports. Additionally, drinking water sales captured $3.2 billion, a 6.3 percent increase; sparkling water netted $1.9 billion and 22.6 percent growth, while value-added waters notched $1.3 billion and 10.6 percent growth. Seltzer waters also saw double-digit growth of 14.6 percent and sales of $337 million, while tonic waters, likely the result of consumers mixing drinks at home, saw a nearly 36 percent YOY increase and sales of nearly $144 million.

In its 2020 Consumer Report, Boston-based Drizly reports that 52 percent of adults surveyed from March through June, reported that they have made more cocktails at home over the previous three months while the country was in lockdown, with slightly more women than men participating.

BMC’s Hemphill says: “Domestic sparkling’s strong performance during the pandemic validates that it is positioned in the ‘sweet spot’ of the refreshment beverage market with all natural, low calorie, carbonated attributes. Consumers’ heightened health concerns during the pandemic likely benefited the category, as did their desires to avoid sugar-laden drinks.

“Both still and sparkling waters are growing, but sparkling has seen greater growth in recent years due to consumers migrating from carbonated soft drinks and some very high-profile product launches,” he continues. “We expect continued growth of both bottled water and enhanced waters. In particular, we believe sparkling water will continue its strong growth and we believe innovation will continue to drive growth in enhanced waters.”

Noting that enhanced waters have a relatively long history going back to the introduction of caffeinated waters more than a decade ago, Hemphill suggests that innovation in the subsegment will expand opportunities in the beverage market. He concludes, “That said, the level of innovation has accelerated over the last five years, which has helped to boost the category. Water makes for a great innovation platform.”

The above content is extracted from the Internet(https://www.bevindustry.com/articles/93488-flavored-enhanced-waters-contribute-to-upward-growth-in-bottled-water-category), so if you want to build a bottled water production line to make money please contact us without hesitation by email info@szsdwater.com.